Time Interest Earned Ratio Interpretation

The times interest earned ratio is a solvency metric that evaluates how well a company can cover its debt obligations. Therefore the Times interest earned ratio of the company for the year 2018 stood at.

Times Interest Earned Ratio Formula Examples With Excel Template

Company DEA has an operating income of 200000 before taxes.

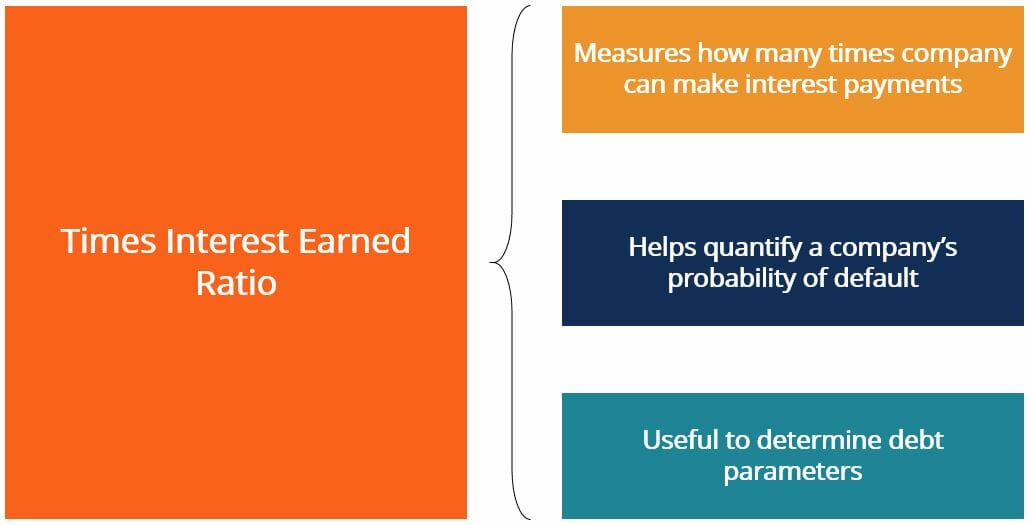

. Time Interest Earned Ratio Interpretation By Da_Alyssa104 30 Aug 2022 Post a Comment The log ratio of CEO relative pay grew 90 log points from 1989 to 2019 with respect. Time Interest Earned Ratio Analysis. The Times Interest Earned ratio TIE measures a firms solvency and whether it can make enough money to pay back any borrowings.

The ICR is commonly used by. To calculate this ratio you divide. For example Company As TIE ratio in Year 0 is 100m divided by 25m.

The times interest earned TIE ratio also known as the interest coverage ratio measures how easily a company can pay its debts with its current income. The Times Interest Earned Ratio or Interest Coverage Ratio is a measure of a companys ability to fulfill its debt obligations based on its current incomeIt is calculated by. For example a company has 10000 in EBIT and 1000 in interest payments.

The ratio gives us the number of times. We can assess the solvency of the companies by calculating and comparing debt ratio and times interest earned ratio for both the companies which are as follows. Tims overall interest expense for the year was only 50000.

In corporate finance the debt-service coverage ratio is a measurement of the cash flow available to pay current debt obligations. Using the times interest earned ratio is one indicator that the company can or cannot fulfill the obligation. To calculate the times interest earned ratio we simply take the operating income and divide it by the interest expense.

How To Calculate The Times Interest Earned Tie Ratio. The higher the ratio the more times over its EBIT can meet its interest expense the easier it can service its debt and the safer a business appears to be. The formula to calculate the ratio is.

To further understand TIE ratios check out the following times interest earned ratio example. The Interest Coverage Ratio ICR is a financial ratio that is used to determine how well a company can pay the interest on its outstanding debts. Tims income statement shows that he made 500000 of income before interest expense and income taxes.

It is calculated by dividing a companys EBIT by its. Times Interest Earned Ratio 729x. Earnings before interest and taxes.

Time Interest Earned Ratio Calculation. It is based on this. The Times Interest Earned ratio can be calculated by dividing its earnings before interest and taxes EBIT by its periodic interest expense.

Times Interest Earned Ratio 6375 million 0875 million.

Times Interest Earned Learn How To Calculate An Use The Tie Ratio

Times Interest Earned Tie Ratio Formula And Calculator Excel Template

Times Interest Earned Ratio Meaning Formula Calculate

Times Interest Earned Tie Ratio Formula And Calculator Excel Template

No comments for "Time Interest Earned Ratio Interpretation"

Post a Comment